As a self-employed business owner, maintaining accurate financial records is crucial for your annual self-assessment tax return. Falling behind on bookkeeping can lead to complications, potentially requiring the assistance of a professional bookkeeper or accountant.

However, if you have confidence, you can complete your return yourself. In this blog post, we’ll discuss the basics of self-employed bookkeeping and how you can achieve it yourself.

Business Accounting Basics has free bookkeeping templates to assist in the process. One template we have received requests for is a cash book from April for the taxation year. The self-employed cashbook template is available for free download below.

Excel templates are an excellent way for self-employed individuals to keep track of their finances. However, we recommend using accounting software like Xero QuickBooks or Sage to manage your finances, as they offer more features and benefits than Excel templates.

At this post’s end are a few frequently asked questions.

Table of Contents

When you are self-employed, having a separate business bank account for your business is important. It will help you keep track of your expenses and profits, making it easier to file your taxes.

A separate business bank account will also make getting a loan or line of credit easier if you need one. Although having a separate business bank account is unnecessary, it is considerably easier to keep track of your business finances if you do.

One of the most critical aspects of bookkeeping is getting organised. You will need to keep all your financial records either paper-based or electronic. It will help you maintain your finances and ensure accurate accounts.

Accounting software packages can upload receipts directly to the software if you want to make sure your bookkeeping is accurate and up-to-date. This way, all your documents are in one place, and you can easily keep track of your spending.

There are several great bookkeeping packages available with free trials, so take some time to research which one would be the best fit for you. Try out a few different options and see which makes the process most straightforward.

XERO – 75% Discount for 6 Months

QuickBooks – 90% Discount for 7 Months

You can claim business expenses on your tax return as a self-employed individual. It can help keep your tax bill low, and knowing what you can claim in tax-allowable expenses is essential.

Some of the most common business expenses include:

It’s essential to keep track of all your business expenses throughout the year, making filing your tax return easier. You can use a bookkeeping package to help you stay organised or keep all your receipts in a folder or electronic document.

When you’re self-employed, keeping track of your finances is essential. It might be tough to handle on your own, which is why accounting software may be helpful. Accounting software can help you keep track of your income and expenses, as well as your assets and liabilities. It can also help you prepare tax returns and invoices.

Some of the providers offer a plan for self-employed accounting software. It can prepare all the figures for the self-assessment tax return and track mileage and time. One of the best choices is QuickBooks.

As software develops, it is easier for businesses to complete their accounts. Some of the most popular packages include Xero or QuickBooks; these all have a monthly cost. A free package is Pandle, which is easy to use. If you are looking at software, take out a free trial and see if the package suits your business.

We have reviewed some of the best accounting software for self-employed and how to choose the best package.

There are several advantages of using accounting software for a sole trader. One of the key advantages is that it helps simplify your tax returns, as everything is in one place.

Some accounting software features include invoicing, sending out invoice reminders, tracking expenses, bank transactions, cash flow, and tracking income. Overall, these features can help manage a business’s finances.

Excel spreadsheets or an equivariant free spreadsheet package gives you the flexibility to design your spreadsheets and get the information you need.

There are many free templates available online. Business Accounting Basics has developed many templates, including profit and loss, balance sheet, cash book, expenses, creditors, debtors, budgeting and invoice. All our templates are available to download for free and without signing up.

Our cash book for self-employed is available below, along with an example.

Paper Based

If you are a small business and do not like technology, you can complete your records using a paper-based system. Stationery shops and places like Amazon sell books and paper with columns that record income and expenditure.

The government has long-term plans called “making tax digital”. This means that future tax returns must be submitted using approved software. Choosing the best way to complete business bookkeeping is one thing to consider.

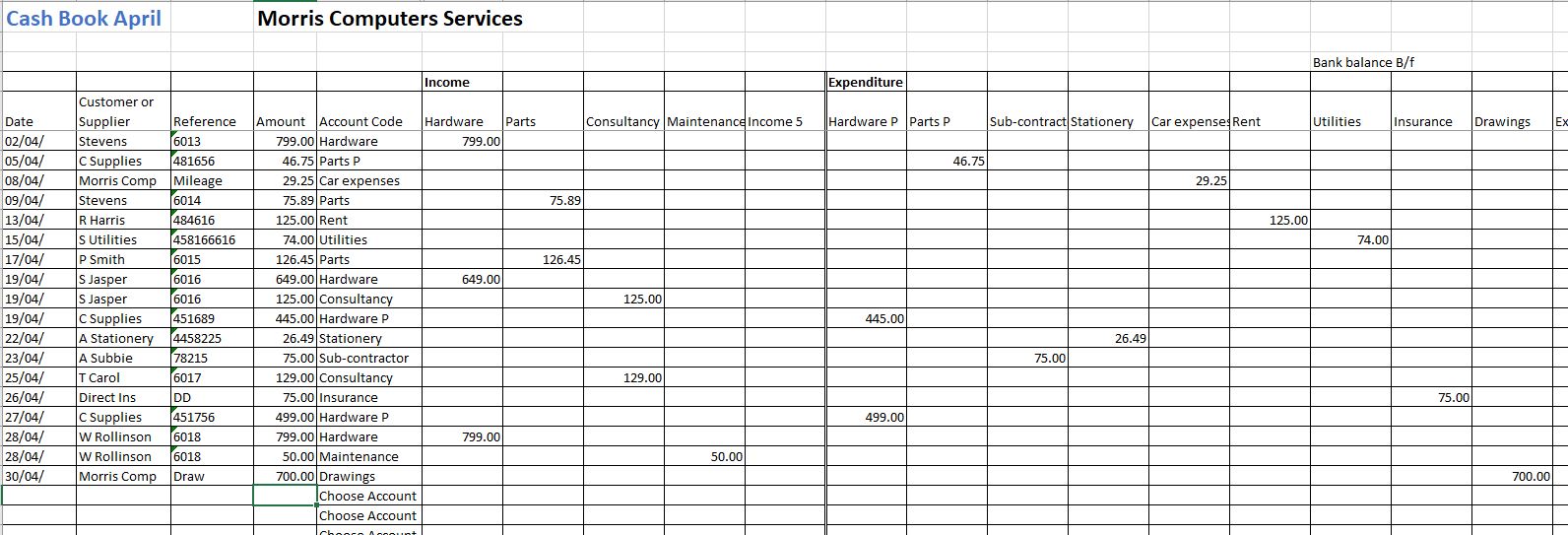

Our self-employed bookkeeping example is based on a computer repair specialist using our free cashbook template. For the business example, they rent small premises, pay utility bills, purchase computer parts and sell their services to repair computers.

All the sales are cash, and he issues a Word invoice as a receipt. Record the transaction in the cash book template once the sale appears on his bank statement. Payment of outgoings is either by debit card or Direct Debit and is easy to track. A few business expenses are also claimed using an expense claim form and paid by bank transfer.

Our free guide is available if you are unsure what business expenses you can claim.

Below is a one-month income and expenditure for April.

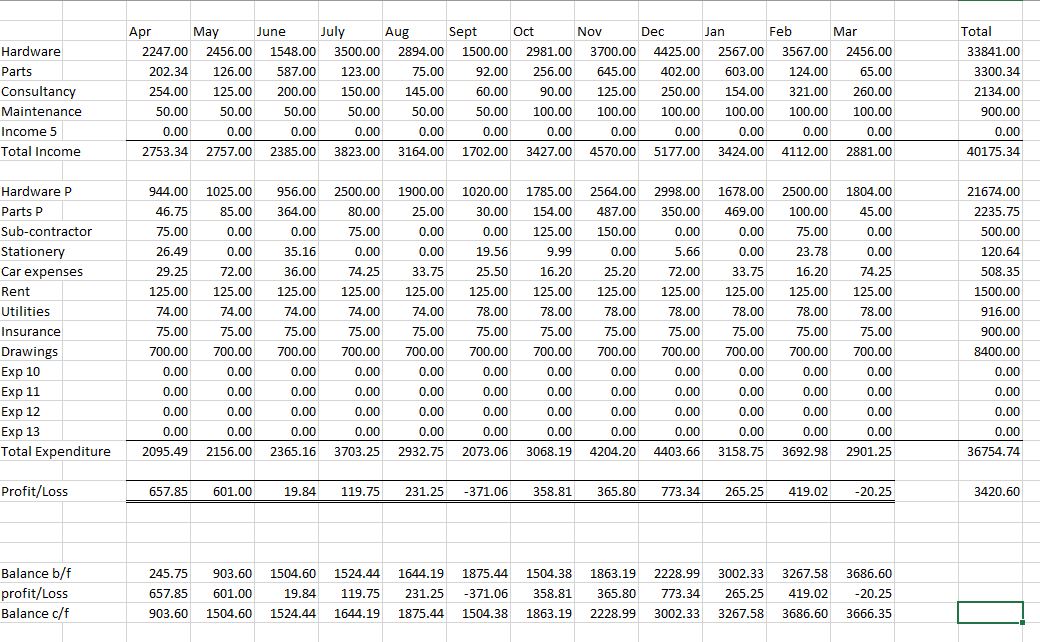

The totals page of the template shows all the figures for April and the end bank balance. You should always ensure that the bank balance is equal to the bank figure. You will need to complete a bank reconciliation if there is a difference.

The totals page will look like this at the end of the year:

Once all the figures are posted for the year, you are ready to submit your figures to HMRC for self-assessment. One adjustment that needs completing is deducting the owner drawings as it is not an expense of the business. In the example, the sales are 40175.34 and expenses 36754.74 – 8400 = 28354.74. The total profit for the company is 40175.34 – 28354.74 = 11820.60.

The business owner will need to pay taxes on the profit. There are self-employed tax calculators that will calculate the taxation that is due. The best calculator is employed and self-employed.

The self-employed bookkeeping template runs from April to March. If your accounting period is from 6th April to 5th April, the best advice is to add April figures to the end of the year into March. It makes checking the bank figures much easier.

Full instructions on using the cash book template are available.

By downloading our free templates, you agree to our licence agreement, allowing you to use the templates for your own personal or business use only. You may not share, distribute, or resell the templates to anyone else in any way.